Larry Rosenberg, CPA

Wealth Advisor, Partner

NORTHCOAST WEALTH MANAGEMENT

We Make Plans, Not Predictions.™

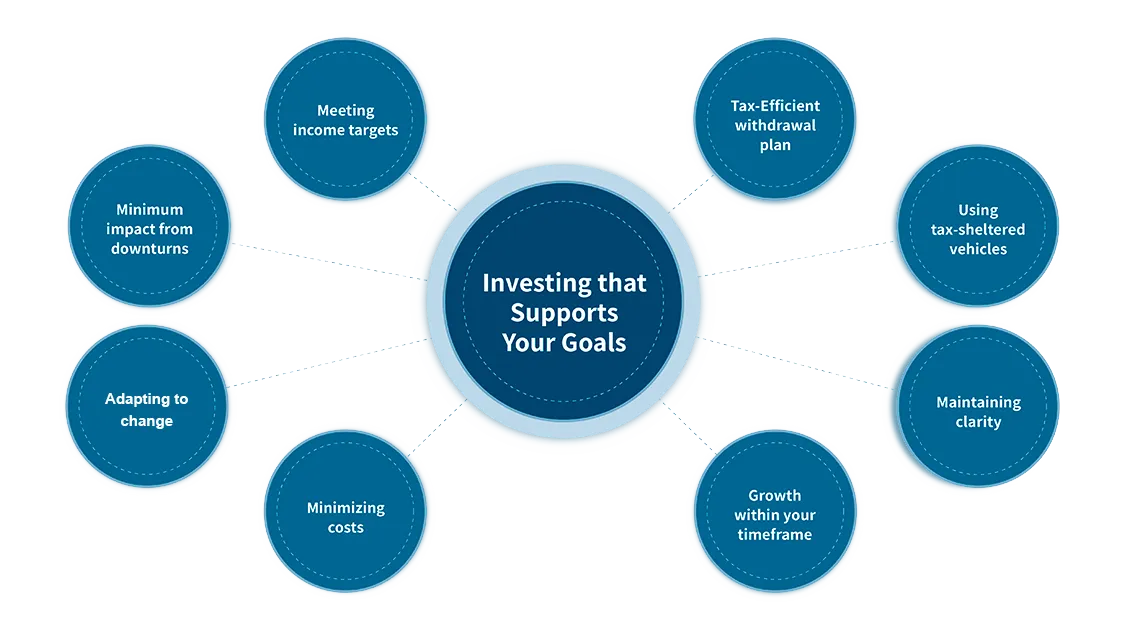

At Northcoast Wealth Management we believe that any decision pertaining to your wealth or your investments should be based not in speculation, but rather in reason, method and careful planning. Pursuing strong performance is about addressing individual needs, which means considering everything from downside risk to tax efficiency, and how they relate to your personal priorities. That’s why we focus on identifying your goals for growth, distribution and preservation, and we manage the strategies that we believe will best achieve that balance over time.

“We’ve been doing this a long time, and we believe there are precepts that prove to be true time and again – you make more when you lose less, you reach more goals when you define them, and you achieve more by planning for the future instead of trying to predict it. “

Investments Based In Reason,

Method And Careful Planning.

Not In Speculation.

EVERYTHING HAPPENS FOR A REASON

What’s The Purpose Of Your Portfolio?

There is endless industry noise around predictions and hot stocks, but the fact remains that market speculation is not in the best interest of our clients. Potential growth in the short term is just one of the considerations that factors into the results we aim to achieve through your portfolio.

MICHIGAN FINANCIAL PLANNERS

What We Do For You

Exclusive Investment Process

With an integrated approach and exclusive strategies, we address wealth preservation goals in each portfolio to help our clients pursue the right investment balance.

Specialized Financial Guidance

Over the years we’ve developed specialized service offerings, made possible by the capabilities of our core team: a Chartered Financial Analyst® (CFA), a Certified Financial Planner™ (CFP) and a Certified Public Accountant (CPA).

Customized Strategic Planning

Our process is focused around aligning your personal priorities with clear objectives and a strategic plan that we actively manage as a team.

RETIREMENT RESOURCES

Download A Complimentary Guide

RETIREMENT AND INFLATION

WHAT TO KNOW AND HOW TO PREPARE

The Legacy and Estate Planning Guide discusses how it’s not just the uber-wealthy that benefit from having an estate and legacy plan. It’s anyone who wants their wishes to be honored after their passing. Essentially, this guide covers the options and tools you have to create an estate plan and the tax benefits of having one. Read this guide to learn the basics of legacy and estate planning.